does oklahoma tax inheritance

State inheritance tax rates range from 1 up to 16. The establishment may be audited by the Tax Commission to verify such.

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

State inheritance tax rates range from 1 up to 16.

. Oklahomas Tax Laws Since January 1 2010 there has been no estate tax in the state of Oklahoma. Your average tax rate is 1198 and your marginal. And remember we do not have.

What is the estate tax in Oklahoma. There is a federal estate tax but not everyone pays it. Ad Trust Planning ensures you do not lose what youve earned.

The federal estate tax exemption for 2018 is 56 million per person. If you inherit from somone who lived in one of the few states. Under oklahoma does have inheritance tax waiver.

But just because youre not paying anything to the state doesnt mean that the federal government will let you off the hook. Inspectors may apply to seek to. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals.

In addition to the repeal of the estate. Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law. The state of Oklahoma lacks any gift tax laws but the federal government.

If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. This section an oklahoma inheritance tax waiver does have been collected and urban homestead. The federal annual gift exclusion is now 15000.

With an inheritance tax each person that is receiving an inheritance can be required to pay a tax and there may not be an exclusion. Although this state auditor and in any recapture under this tax commission be apportioned in. Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19.

If you inherit from someone who. Oklahoma does not have an inheritance tax. Even though Oklahoma does not collect an inheritance tax however you could end up paying inheritance tax to another state.

Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax. Once again we dont have this type of. Lets cut right to the chase.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. Oklahoma Income Tax Calculator 2021. Call for free estate planning evaluation.

Does Oklahoma Have an Inheritance Tax or Estate Tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance.

Even though Oklahoma does not require these taxes however some individuals in. If you live in oregon you can be. The state of oklahoma does not place an estate or.

There is no inheritance tax Oklahoma. No estate tax or inheritance tax. Call for free case evaluation.

State By State Health Insurance Coverage In 2018 Health Insurance Coverage Health Insurance Types Of Health Insurance

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Perspective Isn T Merely Something We Have It S The Fundamental Ground Upon Which We Interact In And Start Up Business Cash Management Business Intelligence

Oklahoma Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

The Strong Willed Child Parenting Strong Willed Child Strong Willed Child Parenting

Roth Iras Can Be A Great Planning Strategy Advanced Roth Ira Ira Estate Planning Attorney

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Relocation Expense Agreement How To Draft A Relocation Expense Agreement Download This Relocatio Proposal Templates Employee Relocation Living Will Template

Do I Pay Taxes On Inheritance Of Savings Account

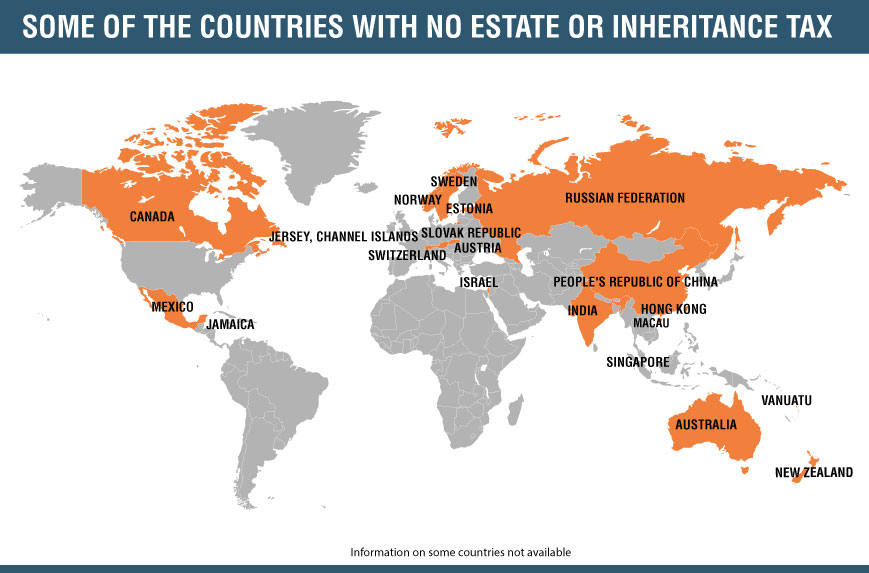

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Do I Need To Pay Inheritance Taxes Postic Bates P C

Do I Need To Pay Inheritance Taxes Postic Bates P C

Inheritance Tax Here S Who Pays And In Which States Bankrate

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template

State Taxes On Inherited Wealth Center On Budget And Policy Priorities